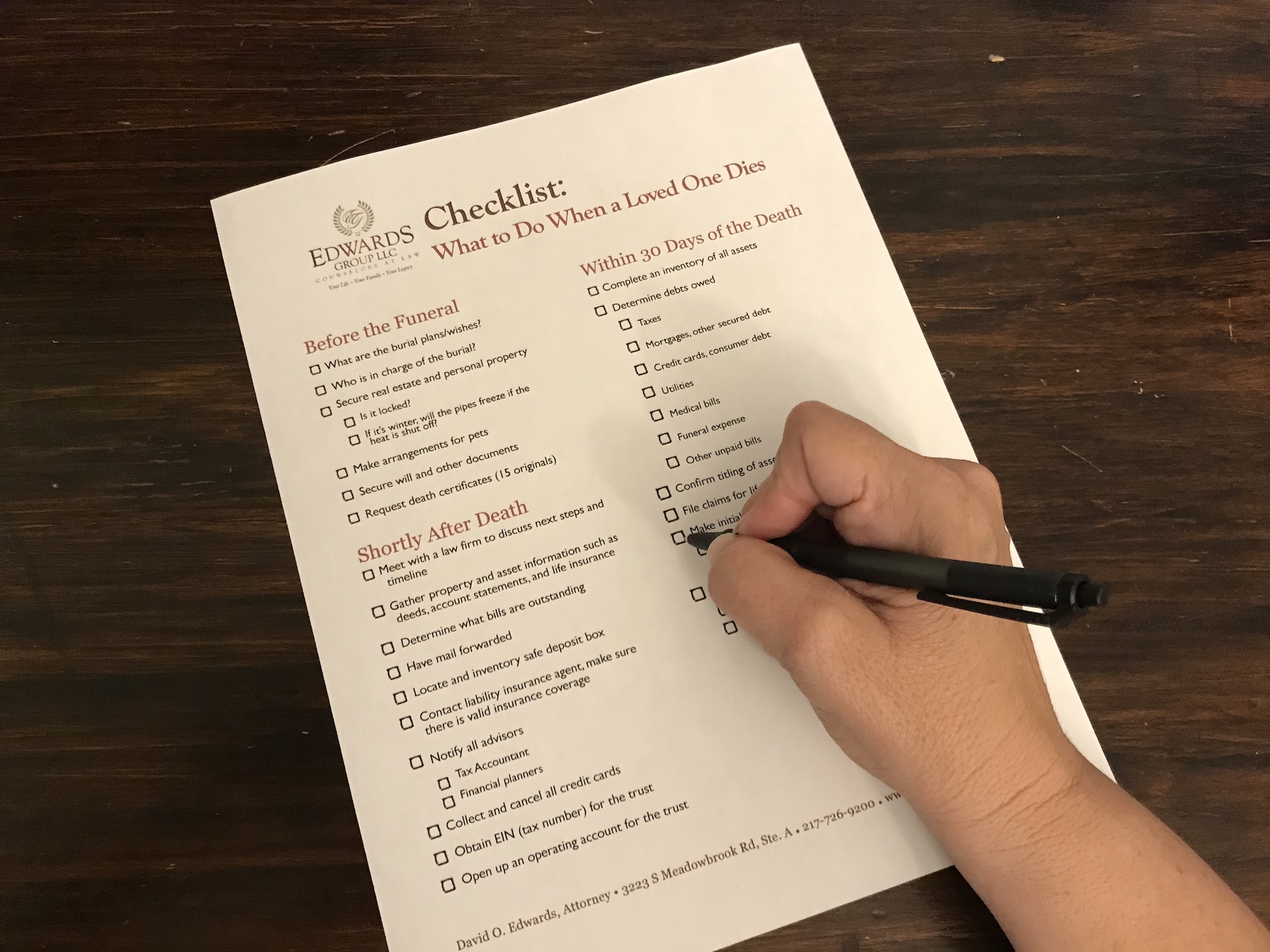

Things can be quite overwhelming when a loved one passes away. Here are a couple of checklists to help you know what needs to be done immediately and what can wait. Feel free to download and print out the checklist on our Resources page. If you need immediate help, please call our office at 217-726-9200.

Things to do shortly AFTER death

- Meet with law firm to discuss steps and timeline

- Begin gathering financial information

- Determine what bills or claims are outstanding

- Have mail forwarded

- Inventory safe deposit box

- Contact liability insurance agent, make sure insurance coverage is adequate

- Notify all advisors (tax, financial, legal)

- Collect and cancel all credit cards

- Obtain EIN (tax number) for the trust

- Open up an operating account for the trust (new account or transfer old account)

- Keep track of all money coming and going, run through that account to make bookkeeping easier

7 things NOT to do right away (No need to be in a rush to do these things.)

- Do not close bank accounts

- Do not file any claims for IRA’s, 401k’s

- Do not drive decedent’s automobile

- Do not contact life insurance or annuity companies

- Do not remove any household furnishings

- Do not pay any bills

- Do not use decedent’s credit cards7

Things to do within 30 days of death

- Complete Inventory of all assets

- Determine debts owed

- Taxes

- Mortgages, secured debt

- Credit cards, consumer debt

- Utilities

- Medical bills

- Funeral expense

- Other unpaid bills

- Confirm titling of assets in the trust

- File claims for life insurance death benefits

- Make initial investment decisions

- Go to cash, short term investments, or adjust long term investments

- Order appraisals

- Real estate (unless planning to sell immediately)

- Other assets (if estate tax return needed)

Download this checklist on our Resources page here.

Do you need the help of an attorney after a loved one’s passing? Read our article Losing a Loved One: 5 Reasons to Hire an Attorney to learn more.