Getting organized is a key part of the estate planning process. Estate planning simply means you have a plan to handle your finances, your care, and your family when you can’t do it anymore — whether that’s because of sickness or passing away.

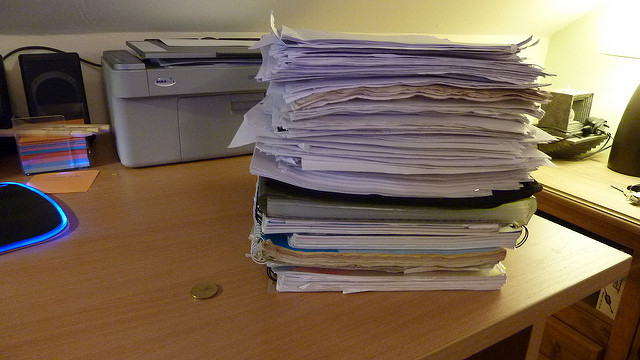

Everyone wants to be organized, and some do a better job than others. Most of us have a “system” to help keep track of important papers. And you understand your system better than anyone else! But if you are seriously ill or dead and gone, will others be able to find what they need?

I have a friend whose mother recently passed away unexpectedly. Sadly, like many people, her mother didn’t have a very good system or plan in place. My friend has had a heck of a time tracking things down. One day, out of frustration, my friend posted this to Facebook:

“Reminder-

No matter how old you are – no matter how healthy you think you are –

Put all of your death documents in at least one file folder.

A firebox would be great, but-

FILE FOLDER.”

Ask yourself — if you were gone today, WHO would be trying to track down all of your financial information, and how would they go about doing it? Have you made it hard for them or easy for them?

Planning tip: make sure you have a complete list of all your accounts, property, and everything else you own. This will make it so much easier on your family later. And obviously, putting all these things in a single file folder could be a big help to your loved ones left behind.

Without a complete list (grab this document off our website to give you an idea of what should be on the list), it will mean extra stress for your family at a time when they are already very stressed. A lack of organization can also create extra court expenses and delays. It could also mean that lost accounts may get turned over to the state.

Laura Peffley, our Senior Asset Coordinator, spends 40 hours a week helping people sort out asset information, doing a complete asset report, and then helping them follow up on planning changes!

If you’d like a guide to help organize things and make sure everything fits with your wishes within an effective plan, then give us a call at 217-726-9200. We’d be happy to make an initial appointment for you. Click here to read about what to expect at that initial appointment.