Big changes in your life may require updates in your estate plan. What kind of big changes? And what should you do about it?

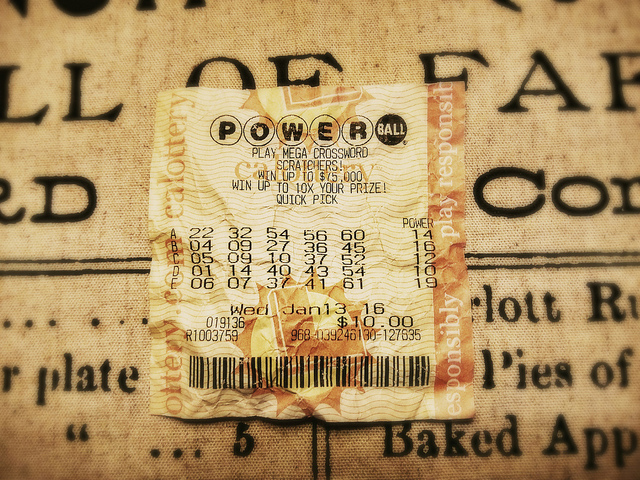

Didn’t win the lottery??

That’s okay. Can you imagine how much life changes after something like that?

The good news is, if you didn’t win the lottery then all the planning you’ve done doesn’t have to change at all.

We’ve worked with several clients recently though, who have gone through big changes in their life, some of whom have received an inheritance, bought a new house, had a loved one get married, or become disabled.

Any of these types of changes in your life could mean that you need to update your estate plan.

We frequently help clients update their plan after big life changes. By updating your plan periodically, you ensure that:

• any new money or wealth will go where it needs to go instead of being eaten up by things like nursing home costs or taxes.

• any planning you did based on your prior home is also done for your new (or second) home.

• your child’s inheritance can be protected in a trust where things like future divorces, long-term care costs or creditors cannot “steal” it away.

While we often help clients who already have done planning elsewhere to update their plans, our Dynasty program has proven to be a simple and cost-effective way to make sure our clients’ plans are always up-to-date. Through this program, we follow up with our clients regularly to confirm that their plan is up to date with the law, but also that their plans capture any changes that have occurred in life, health or assets.

Even more important than updating your current plan, is making sure you have a plan in the first place. Give us a call at 217-726-9200 to get started with an Initial Meeting.

The greatest threat to an effective estate plan is not taking any action at all, so take a step today and call us at 217-726-9200.