Comprehensive Guide to Preserving Your Home & Savings with Legal Planning for Dementia, Alzheimer’s and Parkinson’s

For individuals diagnosed with Alzheimer’s or Parkinson’s and their families, the journey can be overwhelming. Our goal is to simplify this journey for you, providing all the necessary information, tools, and resources to ensure your loved one gets the best care possible.

From budgetary concerns to choosing the right care facility, these resources will answer your pressing questions and give you the knowledge and tools to take control of your loved one’s elder care journey. If you have specific concerns or questions, schedule an Elder Care consultation with Edwards Group.

For individuals diagnosed with Alzheimer’s or Parkinson’s and their families, the journey can be overwhelming. Our goal is to simplify this journey for you, providing all the necessary information, tools, and resources to ensure your loved one gets the best care possible.

From budgetary concerns to choosing the right care facility, these resources will answer your pressing questions and give you the knowledge and tools to take control of your loved one’s elder care journey. If you have specific concerns or questions, schedule an Elder Care consultation with Edwards Group.

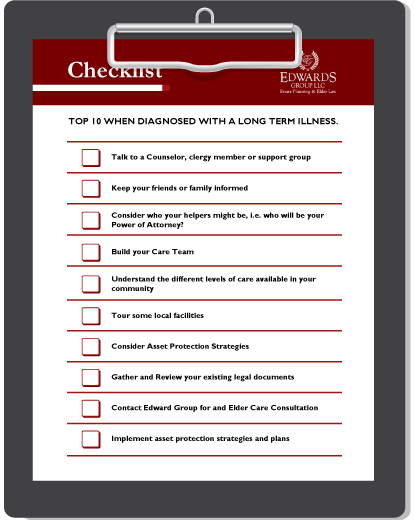

Top 10 Things To Do When Diagnosed With a Long-Term Illness

Being diagnosed with a long-term illness is a life-changing moment, bringing with it a host of new responsibilities and considerations. From seeking emotional support and counseling to strategizing asset protection, it’s vital to be proactive and informed. Use this checklist to prepare and care for yourself in the process.

Protect Your Resources from Nursing Home Expenses

Dementia and Parkinson’s care is not just about medical treatment; it’s a journey that requires holistic financial foresight. Traditional estate planning might not be the best option in this case. Learn the benefit options to help pay for care, how to prepare for benefits qualifications in the future, and protecting your assets. Protect your hard-earned money to avoid it all going to nursing home care, and learn how to strike the right balance.

Protect Your Resources from Nursing Home Expenses

Dementia and Parkinson’s care is not just about medical treatment; it’s a journey that requires holistic financial foresight. Traditional estate planning might not be the best option in this case. Learn the benefit options to help pay for care, how to prepare for benefits qualifications in the future, and protecting your assets. Protect your hard-earned money to avoid it all going to nursing home care, and learn how to strike the right balance.

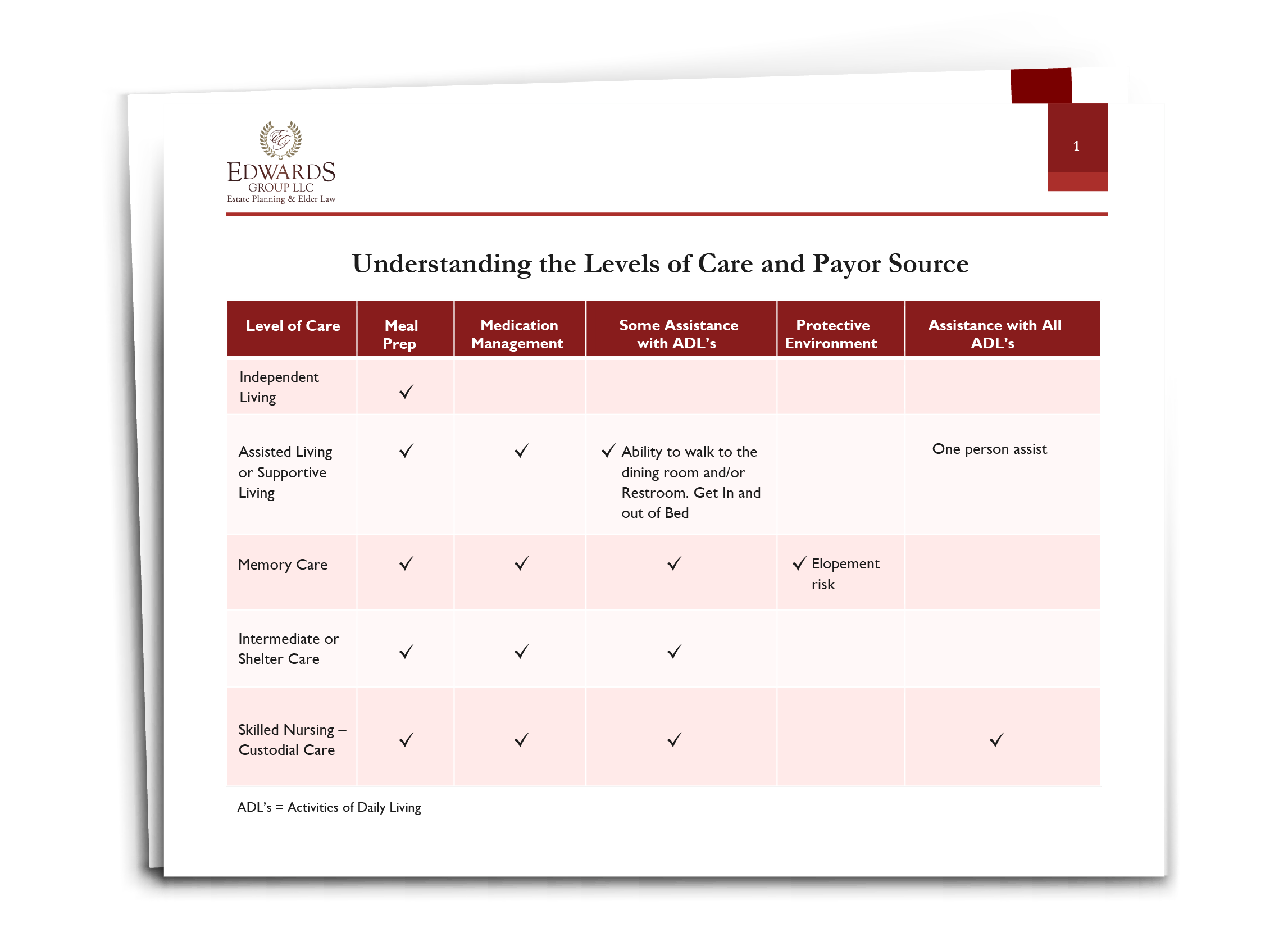

Understanding the Levels of Care and Payor Source

Learn about the different levels of care available for patients based on their needs. Then compare payor sources for each level of care.

Choosing the Right Care Facility

Selecting an elder care facility can be overwhelming, and with so many details to think about, how can you discern the best fit? This blueprint of practical tips to evaluate elder care establishments simplifies the selection process. Make your next facility tour informed and fruitful.

Choosing the Right Care Facility

Selecting an elder care facility can be overwhelming, and with so many details to think about, how can you discern the best fit? This blueprint of practical tips to evaluate elder care establishments simplifies the selection process. Make your next facility tour informed and fruitful.

FAQs

1. What is the main purpose of the guide?

The guide aims to help individuals with Alzheimer’s or Parkinson’s protect their home and savings through effective legal and financial planning.

2. Why is early planning important for Alzheimer's and Parkinson's care?

Early planning ensures that your assets and savings are protected from high long-term care costs, allowing you to qualify for benefits and secure your financial future.

3. What legal documents are essential for someone with a long-term illness?

Key documents include Powers of Attorney for Property and Healthcare, a Living Will, a Last Will and Testament, and a Nest Egg Trust for asset protection.

4. What is a Nest Egg Trust?

A Nest Egg Trust is a legal tool that helps protect your savings from nursing home costs and qualifies you for Medicaid or VA benefits.

5. How can Edwards Group help with legal planning?

The Edwards Group provides comprehensive elder care planning services, including drafting essential legal documents, developing asset protection strategies, and acting as a trusted guide.

6. What are the benefits of having a Power of Attorney?

A Power of Attorney allows someone you trust to make financial and healthcare decisions on your behalf if you become unable to do so.

7. How does the guide assist in building a care team?

The guide provides strategies for selecting and organizing a care team to ensure your care preferences are followed and decisions are made according to your wishes.

8. Can Edwards Group act as a Power of Attorney or Trustee?

Yes, the Edwards Group can serve as your Power of Attorney, Trustee, or Executor, providing professional and experienced guidance.

9. What should you consider when choosing a care facility?

It’s important to visit potential facilities, understand their costs and services, and get on waiting lists to ensure timely access to preferred care options.

10. How much does an Elder Care Consultation cost with the Edwards Group?

“An Elder Care Consultation costs $575 and includes an assessment of your needs, development of a care plan, and review of legal documents and asset protection strategies. Cost subject to change.”

Contact Information

Not sure what you need? We will be happy to listen to you and suggest the service you need.