Imagine if there was a resource out there, specifically for wartime Veterans like you, that could help you pay for senior care costs such as nursing homes, assisted living facilities, and even in-home care. The US Department of Veteran Affairs provides a tax-free benefit to qualifying wartime Veterans and their surviving spouses who may require help with daily living activities.

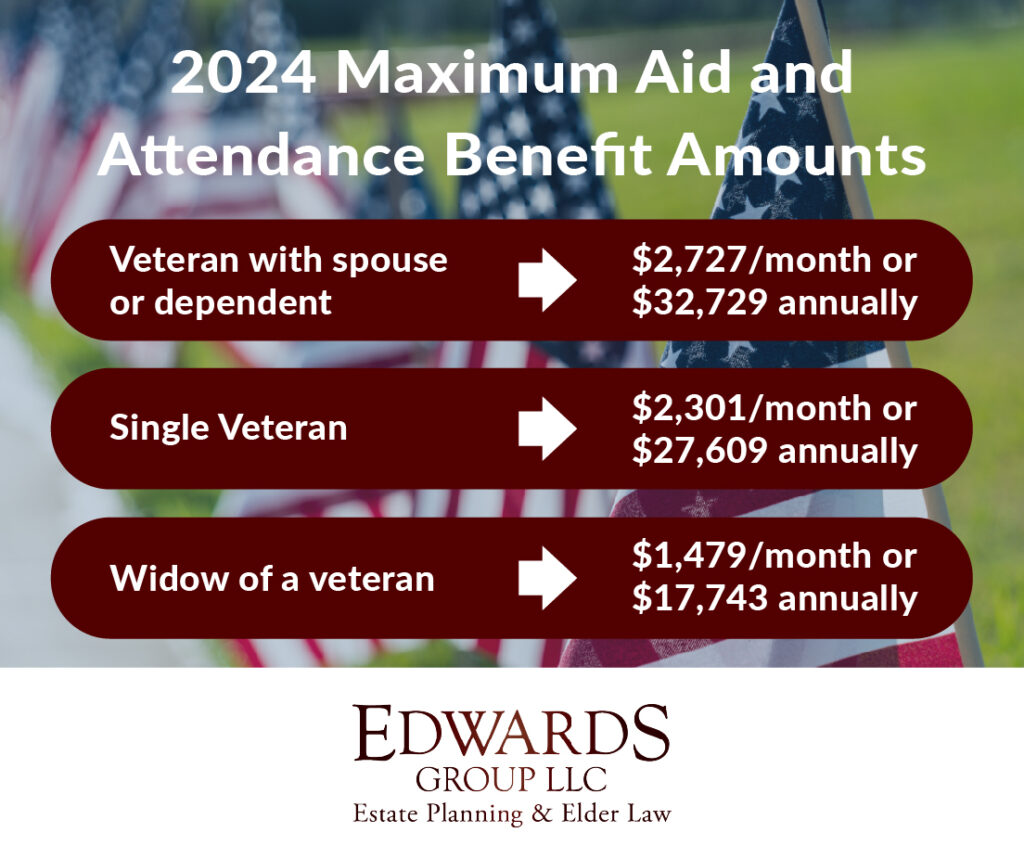

It’s called the VA Aid and Attendance benefit, and it could help save you thousands.

It’s hard to believe, but did you know nearly 72% of all eligible US Veterans who *could* qualify for assistance miss out on the benefits they earned in service to their country? Why? Well, part of the reason may be that many Veterans are not aware that these benefits exist.

That’s where Edwards Group comes in. As a wartime Veteran, you may be entitled to receive certain Veterans’ benefits through the Veteran’s Pension and Survivor’s Pension programs.

We are proud to be one of the only law firms in Central Illinois to be accredited by the VA, and we are honored to assist Veterans like you in obtaining the benefits you’ve earned.

As a wartime Veteran, you have earned and are entitled to certain benefits — benefits that could help you save thousands in costs related to your and/or your spouse’s care and well-being as you age. You don’t have to navigate the VA system alone. Our VA-accredited team of attorneys can work with you to determine your eligibility, safeguard your assets, and get you the benefits you’ve earned.

Are You Eligible for Veterans Benefits?

The first step is to determine if you’re eligible. (By the way, it’s important to note you do not have to be in a Veterans’ facility to receive Veterans’ benefits.) However, there are other criteria that must be met to qualify for Veterans Aid and Attendance Benefits.

To determine your eligibility, we will need to look at four criteria:

- your wartime service,

- your need for assistance with daily activities,

- your medical expenses and

- your asset limitations.

(Note: There are asset limitations you must meet; however, we can provide insight and guidance on how you can best protect your assets now with a Nest Egg Trust so you can be positioned to qualify for these benefits in the future.)

Answer These Four Questions to Find Out If You May Be Eligible for Veterans Benefits

By answering the questions below, you can begin to see if you might qualify for the VA Aid and Attendance program.

So, let’s break this down and dive into the questions:

1. Did you serve during wartime?

Are you a wartime Veteran or surviving spouse of a wartime Veteran? The VA determines wartime periods. To qualify for Veterans Aid and Attendance benefits, you or your spouse must have served during these designated times. As long as you served 90 days, with only one day of service occurring during wartime, you may qualify for these benefits earned in service to your country.

2. Do you require daily living assistance?

Do you need help with at least two (2) activities during your daily routine? These daily activities include things like bathing, dressing, eating, toileting, transferring from bed to chair or vice versa, and continence. If you require assistance with two or more of these activities, that may indicate a level of need that the VA Aid and Attendance benefits could cover.

3. Do you have medical expenses that exceed your ordinary income?

As we get older, our medical expenses are likely to keep rising. The cost of seeing specialist doctors, undergoing treatments, having procedures, getting lab work done, dealing with unexpected illnesses, and more can really add up, especially when our regular income is fixed or stays relatively constant. This eligibility question basically compares the financial burden of medical expenses to our income. The VA Aid and Attendance benefit is meant to help veterans whose medical costs significantly impact their financial situation.

4. Do you have no more than $155,356 in total assets (not including the value of your home or vehicle)?

The specified asset limit is a key determinant of your eligibility. Even if you answered yes to the first three questions, if your total assets are greater than $155,356 (as of the date of this publication), then you may not qualify for certain veteran benefits.

This question specifically focuses on your financial assets (other than the value of your home or vehicle). These assets can include bank accounts, retirement accounts, stocks, bonds, life insurance policies, jewelry, art, and more. When considering your assets, there is a three-year period called the “lookback period,” which is applied to assess financial transactions that occurred in the past three years.

(Note: future applicants for the VA Aid and Attendance Benefit may be able to use a Nest Egg Trust to safeguard current assets in case you need the VA Aid and Attendance Benefit later. More on that below…)

Protect Your Assets with a Nest Egg Trust and Still Qualify for Veterans Benefits

Simply speaking, a Nest Egg Trust is a way to protect your savings and your assets while also planning for future aging and care needs. If you do not currently need these Veterans benefits but think you may need them in the future, a Nest Egg Trust is an excellent way for future benefit applicants to prepare for the future.

You can use this trust to set aside your money and property before the three-year period we talked about earlier. By doing this, you make sure your money and property are safe if you need the VA Aid and Attendance benefit in the future.

Money or property placed in the Nest Egg Trust is not counted after three years when checking eligibility for benefits. This makes it a smart and legal way to protect your assets while maintaining eligibility for future benefits. A Nest Egg Trust can provide peace of mind as well as financial security for you and your family as you navigate the complexities of long-term care planning.

Get Started with a Workshop or an Elder Care Consultation

If you’re interested in safeguarding your assets and qualifying for crucial VA benefits, consider scheduling an Elder Care Consultation with Edwards Group. Our VA-accredited attorneys can explain how a Nest Egg Trust could work for you and provide personalized guidance tailored to your unique situation. We are committed to helping you navigate the process effectively so you can get the benefits you’ve earned and deserve. Call us today at 217-703-7641 to schedule a consultation or sign up for an upcoming workshop where you can learn more.

A Reminder That Veterans Benefits…

- Can help you afford the care you need

- Are tax-free and never have to be repaid

- May be used to pay for a nursing home, assisted living, in-home care, and other care costs.