Did you know you do NOT have to “spend down” your hard-earned savings to qualify for nursing home or assisted living Medicaid benefits? New changes to Medicaid rules in the State of Illinois favor Medicaid recipients.

If the thought of paying for long-term care expenses such as assisted living, memory care, or nursing home care worries you, read on. The Elder Law team at Edwards Group knows the legal strategies and tools that can be used to increase and accelerate your Medicaid eligibility, protect your assets, and save you thousands. We’ve been helping families in Central Illinois qualify for Medicaid to help with care expenses for over a decade.

Medicaid Can Help Pay for Long-Term Care Expenses

Let’s be honest. No one likes to talk about the possibility of needing help as we age. And most people believe they don’t meet the requirements for Medicaid to pay for care benefits.

The truth is, at some stage in the future, most of us will probably require some additional help. We plan for retirement and our children’s college education, but we often overlook the expenses associated with extra care as we age. Thinking about this now and creating a plan to age is essential to our future financial responsibility. The need for assisted living, memory care, or skilled nursing care is not uncommon as we get older. And these things are expensive.

But there is help available…

Long-time Care Medicaid, a medical benefits program for people living in a supportive, memory care, or skilled nursing facility, can help pay for needed care as someone ages.

Unlike Medicare, a federal health plan for those 65 and older, Medicaid is a federal benefit program whose rules vary from state to state. This means the state of Illinois has its own set of Medicaid rules, guidelines, and asset limits.

Changes To Illinois Medicaid = Good News for Medicaid Recipients

In early 2023, Illinois lifted the Public Health Emergency in place during the COVID-19 pandemic and established new guidelines.

These new Medicaid guidelines were long overdue and are favorable for Medicaid recipients.

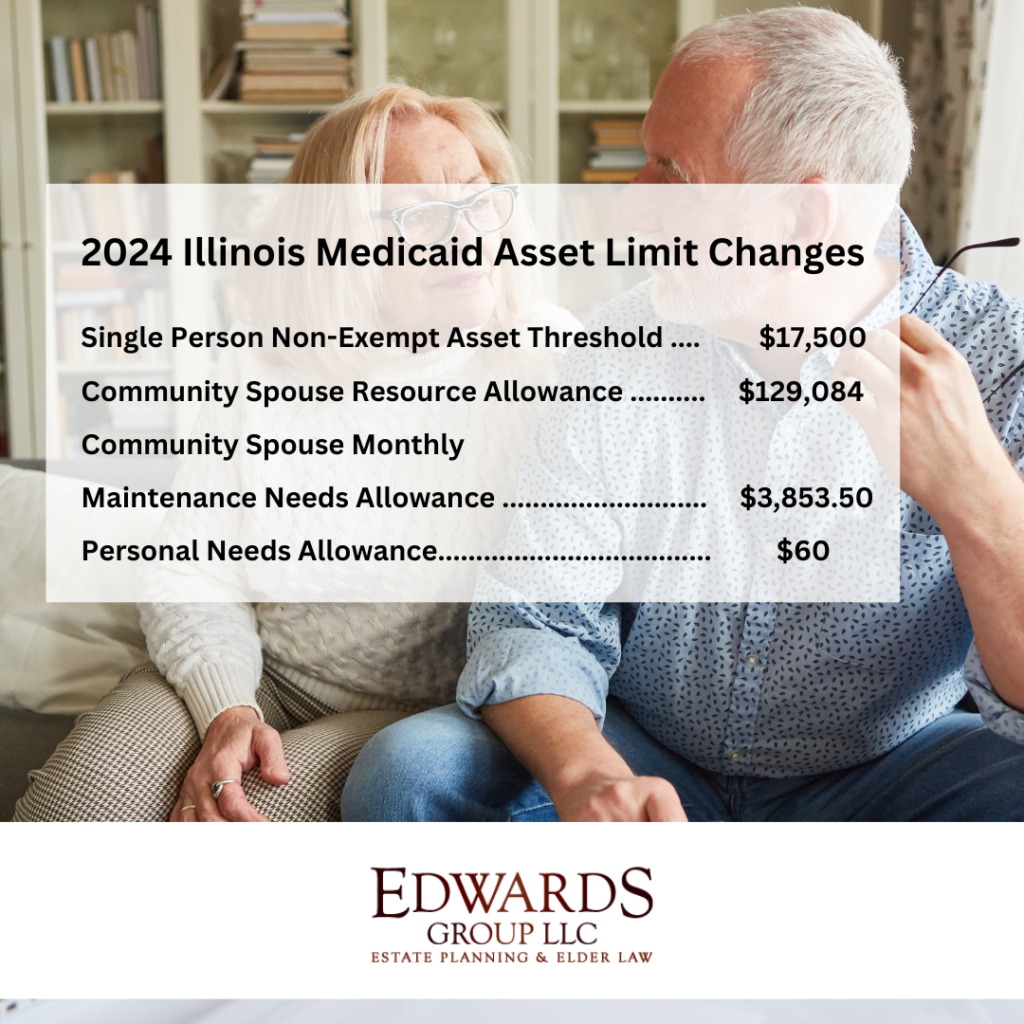

Essentially, the threshold and allowance numbers have increased. And an increase in the asset caps means you can keep more of your hard-earned money and assets.

So, the question now becomes, how can you best balance the potential need to pay for long-term care without depleting the assets you’ve worked so hard to build?

That’s where Edwards Group can help.

Edwards Group Can Help Guide You Through the Process

The Elder Law team at Edwards Group can explain what these new rules and guidelines mean for you or your loved one. Our goal is to help you prepare to cover long-term care expenses related to assisted living, memory care, or skilled nursing home care.

The area of Elder Law also provides guidance for decisions that will become important later in life. We know that anyone can experience unforeseen health issues or diagnoses, which may affect people’s ability to make decisions about many things, including their healthcare, their estate, finances, and more.

Preparing now, proactively, before any emergency or unforeseen health emergency arises, is key. It may sound overwhelming, but the good news is it doesn’t have to be. Together, we can use legal strategies to help you protect your assets while ensuring you have coverage for the care you may need down the road.

At Edwards Group, we help you successfully navigate the next chapter of your life. Ultimately, our mission is to give you peace of mind, knowing you’re prepared for whatever the future holds.

It’s never too late to start planning, even if you’re currently writing checks to the nursing home!

Learn more at an upcoming workshop – 7 Things You Need to Know Before Going to the Nursing Home!

Or call to set up an Elder Care Consultation (ECC) with our Elder Law team. The ECC is a 60-minute meeting where our experienced Elder Care Director, Melissa Coulter, will discuss the needs you or your loved one may have, help prioritize those needs, and assess if eligibility to pay for care can be established through government programs like Medicaid and Veterans Aid as well as local resources and tools.

Don’t assume you won’t qualify! Everyone’s situation is unique and different. RSVP for a workshop or call to schedule your Elder Care Consultation today.