Our Blog

Popular Posts

Medicaid Help

When a loved one needs nursing home care, that is one of the most stressful things a family faces. We help families every day deal with this difficult issue. One of the biggest concerns is often “how do we pay for it?” Nursing homes are expensive, often $10,000 per...

Is Your Loved One in a Nursing Home?

Is your spouse, parent, sibling, or loved one in a nursing home? Are you worried about running out of money? Have you been told it’s too late to protect assets? These are common concerns we hear when meeting with clients for the first time. Our advice is this: It’s...

4 Questions to Answer When Facing a Healthcare Crisis

Most people don’t connect estate planning and a healthcare crisis. However, as people live longer and face the skyrocketing costs of aging in America, a new aspect of estate planning has emerged. We call it “Life Care Planning.” This type of planning addresses the...

Our Blog

Kids Leaving the Nest This Fall Need a POA

When your kids get ready to leave the nest, be sure to have a Power of Attorney for them. This past Spring, Tarina, our Client Relationships Coordinator, had a front row seat to some new Edwards Group babies. The baby robins hatched from their beautiful blue shells at...

Is Your Estate Plan Old and Clunky?

David Edwards loves what he does, and it's obvious because he can connect just about anything to estate planning! In this post, Dave and his dad explore how estate planning is like... old tennis rackets. Estate Planning is Like... Old Tennis Rackets When my...

10 Non-financial Planning Issues (Infographic)

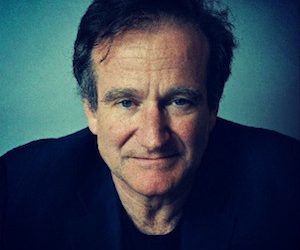

Your “Special Stuff” List: Lesson #2 from Robin Williams

One of the best ways to minimize fighting amongst your family after you're gone is by creating a "special stuff" list before you go. Creating a "Special Stuff" List Can Minimize Fighting Amongst Your Family After You're Gone Last week, we talked about having "The...

A Lesson from Robin Williams: Having “The Conversation”

One way in which you can minimize fighting amongst your family after you're gone is by having "The Conversation" before you go... Does Your Family Have Trust Issues Like Robin Williams? After his death in 2014, it appeared that Robin Williams did everything right when...

3 Myths About Choosing a Helper for Your Plan

We've talked previously about what a "helper" is and why it's so important to not only choose one, but choose a good one. Whether it's as a trustee, executor, power of attorney or guardian, it's very important that you choose someone who is up to the task. Here are 3...

Estate Planning is Like… Birthday Cake

Much like your favorite birthday cake flavor, everyone likes different things when it comes to estate planning. Well, as of March 5, I'm another year older! And to celebrate I got to have the best birthday cake in the world -- spice cake with chocolate icing! What...

6 IRA Planning Tips

Here are 6 IRA planning tips you should consider for your family: 1. Help your grandkids with their own IRA Anyone who starts an IRA early, in their teens or 20's, will see it grow to huge amounts by retirement. But young people often don't have the funds to put into...

7 IRA Planning Traps to Consider

When it comes to your IRA, there are some planning traps you need to look out for... Here are 7 IRA planning problems to consider: 1. Incorrect beneficiaries - This is very basic, but often overlooked. Confirm that the beneficiaries are set up correctly. If you lack a...

The Lifecycle of an IRA: 4 Stages

There are 4 stages in the lifecycle of your IRA, and each one gets progressively more complicated. The last stage is "What happens when I'm gone?" Here is what you need to know about each stage leading up to the last: Before age 59 1/2, you are usually paying into the...