Our Blog

Popular Posts

7 Ways to Check On Aging Loved Ones This Holiday Season

The holiday season has arrived again, and there's a lot to do! Baking, shopping, decorating, planning, wrapping, etc. The hustle and bustle of the season will usually be followed by special times with our friends and family, so this is a great time to check in on how...

Social Security and SSI Benefits Increase in 2024: What Retirees Need to Know

As we approach the new year, important news has arrived for retirees across the nation. The Social Security Administration recently announced a 3.2 percent increase in Social Security and Supplemental Security Income (SSI) benefits for 2024. This welcome news means...

5 Big Risks of Adding Your Kids to Your Bank Account

The Truth About Adding Your Child(ren) to Your Bank Account Many parents think that "adding their children to their bank account" is an easy way to be sure their kids can help if something unexpected happens, but it can cause some unintended consequences. Legally, you...

Our Blog

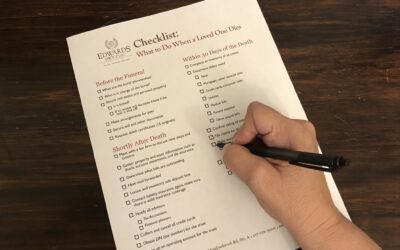

Checklist: What to do When a Loved One Dies

Things can be quite overwhelming when a loved one passes away. Here are a couple of checklists to help you know what needs to be done immediately and what can wait. Feel free to download and print out the checklist on our Resources page. If you need immediate help,...

How to Choose Good Helpers for Your Estate Plan

As you complete your estate plan, you will need to name various "helpers." These are the people who will carry out your plan when the time comes. When will that time be? When you are disabled or you pass away. These helpers will be there to oversee the legal and...

Getting Old Ain’t for Sissies: 9 Things to Consider As You Get Older

As anyone who is aging can tell you, the old saying is true: The days may be long, but the years are short. Time may be speeding by so much that there's a good chance you haven't sat down to discuss with loved ones the different things you should consider as you get...

Your Bucket List for Estate Planning: Why a Trust Might Be Right for You

The Bucket List, a 2007 Morgan Freeman and Jack Nicholson movie inspired a lot of people to think about their own bucket lists, or the things they would like to do before they die. While a trip around the world in a sailboat may seem a lot more exciting and...

(Video) Beware of What Happens When You Give Your House to Your Kids

When faced with the shocking costs of long-term care or a nursing home, many people have to scramble to figure out a way to pay the enormous fees. Realistically, the $7000+ a month it costs for a nursing home in Central Illinois is a big financial burden for most...

What’s the Difference Between a DNR and a POA?

End of life documents can be quite confusing and intimidating (the use of acronyms doesn't help). So we'd like to set the record straight and help clear things up. Let's start with the types of documents commonly used: POA This simply stands for Power of...

Approaching End of Life Issues With Forethought

Diagnoses like dementia and cancer are hard to receive. While these conditions are often treatable, and it's possible to live with them for a significant length of time, the unfortunate truth is that no one can live forever. That's why it's important to put thought...

Caring For Your Loved One

Oftentimes, people need to quickly understand how to best care for their aging family members, which leaves them feeling desperate and overwhelmed. Many legal, medical, financial, and care decisions must be made, and it’s important to honor your loved one’s wishes....

8 Costly Myths About Wills

There are a lot of misconceptions surrounding wills and estate planning. These wrong assumptions cost families time, money, and stress on a regular basis. Here are eight costly myths about wills that you should be aware of: 1. Wills avoid probate. False! In fact,...

14 Home Healthcare Mistakes to Avoid

Choosing home healthcare can be a very difficult and complicated decision. Experienced elder law and estate planning attorneys should be able to help you avoid home healthcare mistakes because they have experience in this area. We actually have quite a few tools that...